Commercial property investment figures for the City of London, produced by Savills, show that £1.77bn had been invested by the end of June, representing a year-on-year decrease of 41%. The data shows that just three deals were transacted in April, four in May and three in June.

Although this lack of activity is negative news, recent analysis indicates reasons to be optimistic for the future. Around £2.62bn of commercial property is currently under offer in the City, across 21 transactions.

Savills report that formal bids have recently been placed on two development opportunities, both of which have generated a high level of interest from potential buyers, underlying the long-term faith in the office market in the City.

One prime reason for the low level of transactions has been the lack of available stock. In addition, travel restrictions have made property viewings from international investors particularly challenging, a situation which will correct as travel restrictions ease. Savills feel the ‘weight of overseas capital looking to London, which has proven robust as values have largely held firm to date, is encouraging.‘

As the pandemic continues to weigh heavily on commercial property, the retail sector has been significantly adversely affected. According to commercial property development and investment company Landsec,

under a third (29%) of retailers in their properties paid their rent in June. Retailers paid just £9m of the £31m rent due on stores on 24 June, compared to last year when retail tenants paid 92% of the bill.

In a statement, Landsec, who run Bluewater shopping centre in addition to others, detailed, ‘COVID-19 has resulted in some customers taking longer to pay their rent and we continue to have supportive and constructive dialogue with our customers.‘ For the two-week period commencing 15 June, when non-essential retail was permitted to reopen in England, shopper footfall in Landsec centres was 40% down on the same period last year.

A temporary ban on the eviction of high street businesses in England, Wales and Northern Ireland, introduced by the government, has been extended from 30 June (original deadline) to the end of September.

Due to the pandemic, various property developments in the Scottish cities of Edinburgh and Glasgow have been delayed as investors have become increasingly cautious.

A recent market review, conducted by Lismore Real Estate Advisors, outlined that although Q1 2020 was an encouraging period for transaction volumes, by the end of Q2, Scottish transaction volumes had fallen by around 70%, when compared with the five-year average for the same period.

The review highlighted that most investors were choosing to adopt a ‘wait and see’ approach to new property developments and opportunities, with focus placed on the receipt of rental income from existing commercial property investments. The pandemic is likely to set back development projects in Glasgow and Edinburgh by at least six months, leading to a reduction in investment opportunities.

When analysing the future of Scottish offices for the next 12 months, the review found that nearly 50% of investors expect to purchase offices, with 39% intending to sell. More than half predict that rents will remain static, with 5% anticipating growth. Looking specifically at Edinburgh office space, the review outlined that the capital has a robust track record for attracting both UK-based and international investors.

![]()

Source: Zoopla, data extracted 21 July 2020

| REGION | NO. PROPERTIES | AVG. ASKING PRICE |

|---|---|---|

| LONDON | 1,218 | £1,014,461 |

| SOUTH EAST ENGLAND | 1,368 | £597,853 |

| EAST MIDLANDS | 998 | £858,390 |

| EAST OF ENGLAND | 815 | £465,996 |

| NORTH EAST ENGLAND | 991 | £297,085 |

| NORTH WEST ENGLAND | 1,813 | £413,327 |

| SOUTH WEST ENGLAND | 1,863 | £588,700 |

| WEST MIDLANDS | 1,326 | £446,191 |

| YORKSHIRE AND THE HUMBER | 1,443 | £346,751 |

| ISLE OF MAN | 52 | £479,025 |

| SCOTLAND | 1,522 | £259,246 |

| WALES | 851 | £376,378 |

| NORTHERN IRELAND | 34 | £390,253 |

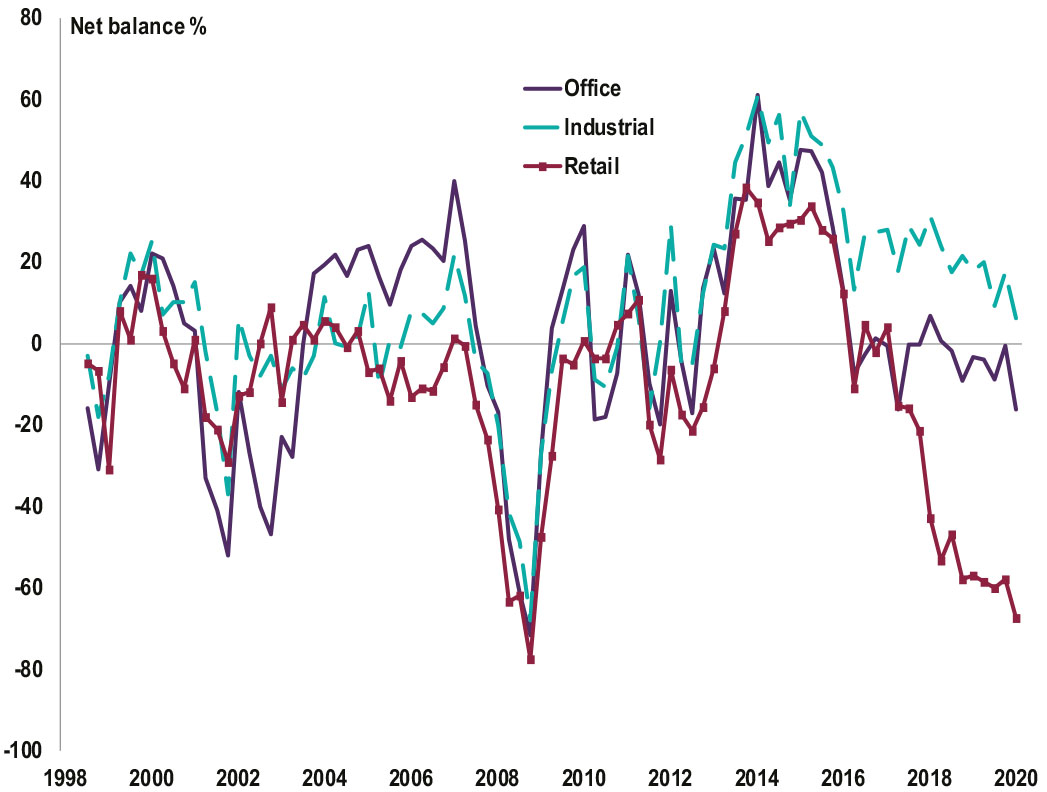

Source: RICS, UK Commercial Property Market Survey, Q1 2020

Source: OBR, Fiscal Sustainability Report, July 2020

|

All details are correct at the time of writing (21 July 2020)

It is important to take professional advice before making any decision relating to your personal finances. Information within this document is based on our current understanding and can be subject to change without notice and the accuracy and completeness of the information cannot be guaranteed. It does not provide individual tailored investment advice and is for guidance only. Some rules may vary in different parts of the UK. We cannot assume legal liability for any errors or omissions it might contain. Levels and bases of, and reliefs from, taxation are those currently applying or proposed and are subject to change; their value depends on the individual circumstances of the investor. No part of this document may be reproduced in any manner without prior permission.